TLDR:

Startup fundraising starts well before you are actively raising (lessons from +$100M raised). When done well it is a competitive Auction. There are 3 main phases: a) build an interested investor pool, b) do “price discovery” regarding the amount, valuation and terms and c) run a competitive auction that simultaneously brings interested investors to the table. This meaningfully increases the likelihood of closing quickly, with the right investors and good terms. Much more below including practical steps and templates.

Startup fundraising playbook – running a competitive auction

Many people say startup fundraising is similar to enterprise sales, after raising over $100M with 8 different startups, I disagree. Fundraising is a thoughtful process that ends with an Auction where the founder is the auctioneer (specifically, fundraising is a Sealed Bid Auction). Your goal is to bring many interested bidders (VCs) to bid on leading your round at roughly the same time so you can choose and improve the best offer.

So what do you need to do to succeed, first always be building an amazing startup. Second, organize a compelling and competitive auction every time you raise money.

A few essential facts to begin with:

- The auction itself is the last stage. There is foundational prep work that must to happen to enable a successful auction.

- Not doing an organized process increases the likelihood of a poor outcome (lower valuation, lower amount raised, bad terms, lower quality investors, or not being able to raise at all)

- You are always engeged in fundraising but very differently depedning on your stage. This is what this post is about.

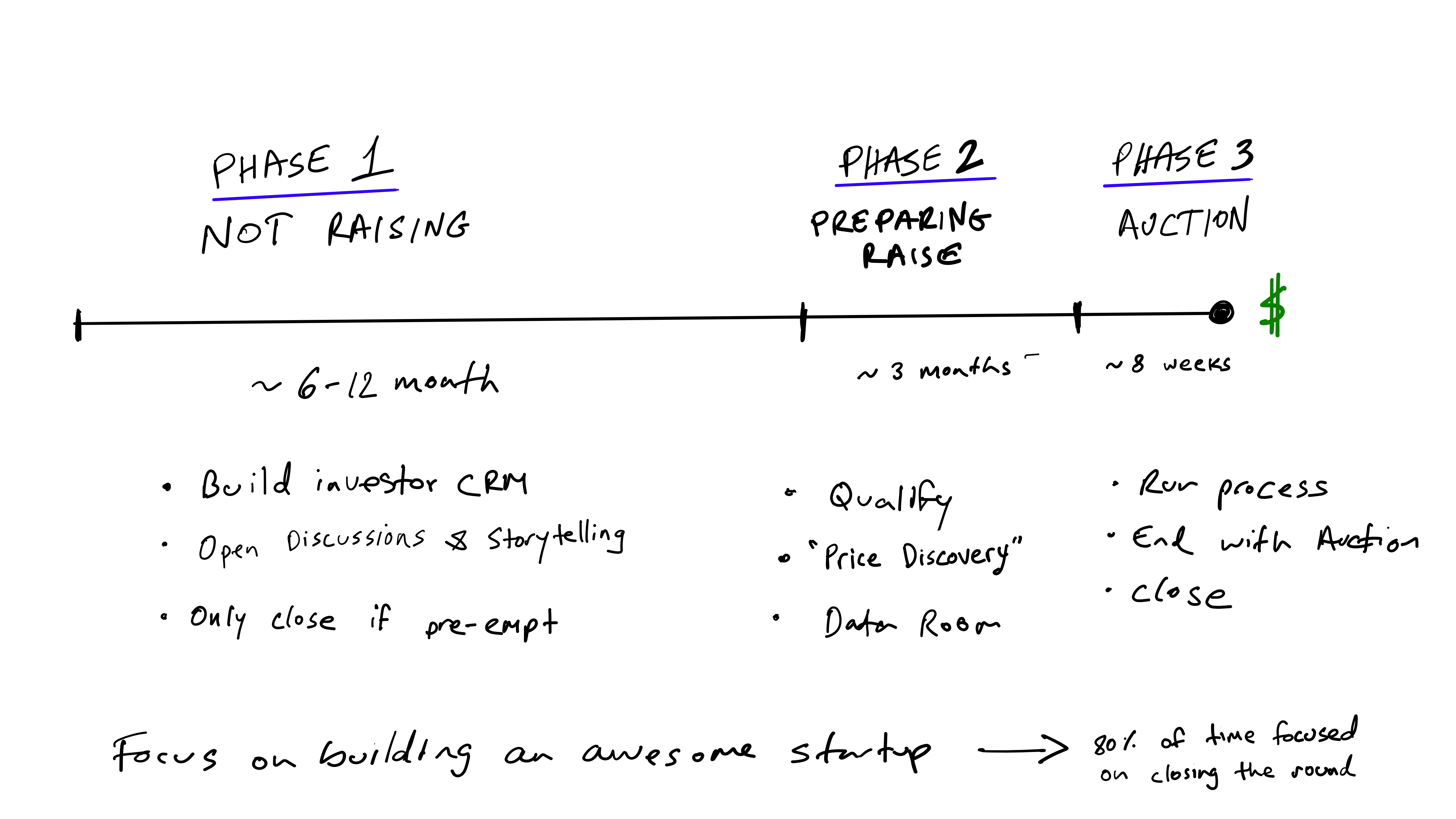

Fundraising has three phases:

- Phase One – “Not raising” ~6-12 months before you start to run the Auction (Phase 3)

- Phase Two – “Preparing to raise”, ~3 months before your start raising

- Phase Three – “Running the auction and actively raising” – running an organized, high velocity, competitive process to close a round (takes ~8 weeks)

Phase 1 – “Not raising” (except if an investor preempts)

You are not actively raising but are setting the groundwork. You do this ~6-12 months before you plan on raising/running the auction, with the main focus being:

- Meeting potential investors for friendly and informative conversations – create an investor CRM (sheet) and have open conversations with potential future investors. Share with them your business and ask for advice on topics that matter to you. Have real and honest conversations about your business, and also about them. Their areas of focus, investing style, typical amounts they invest, whether they lead or not and when, etc. You are not yet raising, be clear about that from the get go and build rapport. You are:

- a) giving the investors more data points for their time series (investing is a line not a dot) so when the time comes they have a much more informed opinion and

- b) hearing the perspectives of highly-intelligent people who see a lot of startups and can share interesting advice

- c) signaling that you are doing this with other investors so when the auction begins it will be competitive.

- Meeting connectors/advisors: similar to investors, create a connector CRM of a) people you know and trust b) people in your industry or solution space and c) other high-profile people who want to see you succeed. Schedule short touchpoints with them regarding your startup. Share your progress and discuss topics that matter to you where they could have interesting perspectives. This is an incredible resource to cultivate generally, but even more so as preparation for fundraising, when the time comes they will provide high-quality intros and signaling to investors that there is an auction and that investors should pay attention and compete to invest.

- If you are seeing lack of excitement and limited followups (from investors and connecters), there is either a problem with your startup or the way you share your story and progress. It’s ok for many of the people to reject you, but some need to love what you are doing and offer introductions, followup meetings, client references, etc. One of the worst feedbacks you can get is a “Sounds interesting, but let’s keep in trouch” it means it’s not interesting enough for any action to be taken. Don’t give up of course and this person and keep in touch, BUT figure out why your not generating more excitement. This post might help.

- You should also start paying attention to “Price discovery.” It will become critical in Phase 2. In our case, you want to “discover” the amount to set for your next raise, valuation, terms and goals that you need to achieve to correspond. You’ll hear clues to these in the conversations with investors and connectors. Look for details on comparables (e.g., company X just raised $20M and they were similar to you except they had 15 paying clients, a strong pipeline, etc). Also, take note of the interest level people share regarding your startup and progress, these will become critical indicators later on.

- The only way a round should close at this stage is if an investor wants to preempt. They need to be very excited (and likely also feel FOMO that if this reaches an auction they will not get an allocation or the price will be way higher than what they are able to get by pre-empting). If they raise this option, you say you are not really raising, but if the investor insists, you negotiate not only the investment amount and valuation, but also minimal disruption to the business and a short due diligence process. If they want to do through business due diligence and for you to create materials for them, it’s almost always a mistake to progress. This will hijack your auction, cause you to spend a lot of time with them and not give you the opportunity to create a competitive process/auction. You should only progress if they are willing to:

- Share a term-sheet quickly with terms that you like

- Progress with the information they mostly have already (as opposed to starting a business DD process)

- Commit to a very fast “Confirmatory DD” (i.e., only checking for legal/accounting red-flags)

- VERY important to know the difference between a real preemption/conviction and a masqueraded hijacking. If you are not sure ask directly, tough questions of the investor even at the risk of losing the pre-emption. If the intent to pre-empt is real, not only will you not lose it, you will in fact increase the likelihood of it happening.

If this is not the case, they don’t really want to preempt, but want you to launch the process specifically for them and before you are ready.

Phase 2 – “Preparing to raise”

In this phase, you are more actively meeting prospective investors, starting to finalize your “price discovery” and are also starting to create a deck & data room for Phase 3.

Main actions are:

- Continue to bulk up your Investor and Connector CRM:

- Follow threads of trust and willingness to help to grow your network and having good (and typically short 30/60 min) conversations with additional potential investors and connectors.

- The framing is NOT we are raising a round let’s chat, but rather, X is a super interesting startup/founder I’m sure you’ll enjoy chatting with them (and “they are starting to think about fundraising so if you want a shot when they do you should chat/help them”). Again, friendly conversations, ask interesting questions and get advice.

- Start qualifying investors while you talk with them (ask questions along the lines of how interested are they in investing in your space? How much do they know the field? Have they done any investments in the field? Do they have a specific thesis? Who’s the partner focusing on this?) Don’t let any investor hijack or kick off your process for you before you are ready (unless they are credibly trying to preempt – see Phase 1 commentary). Track who is being helpful or at least trying to help you push your startup forward. Ones that are interested in potentially being a lead will start expressing that interest trying to get closer and offer help (introductions, research, ideas, etc.).

- Categorize investors to value add vs. pure financial investors – you can be implicit or explicit about it. The proactive value add investors will rely on their network (LPs, strategics, customers, etc.) to preemptively DD you which may actually help in the form of introductions to customers. Alternatively you can implicitly state that you find most value in getting to know investors through their networks and value add. The most aggressive approach would be in the form of stating that to proceed you would expect significant value in addition/advance to capital. .

- Follow threads of trust and willingness to help to grow your network and having good (and typically short 30/60 min) conversations with additional potential investors and connectors.

- Focus on price discovery – at this stage you want to start narrowing down the amount and valuation you are going to ask for based on your achievements and investor interest. Go too low and potentially leave a lot of money/equity on the table, too high and no one will bite and give you a term sheet. This is both an art and a science and deserves it’s own separate blog post. It’s critical to note that until you have a “good sense” of Price discovery and interest from enough investors you should NOT launch the auction, it requires both to be successful.

- Create and commit to your internal fundraising plan and timeline, use this template as a starting point:

- The key steps are to finish preparing the materials, then thoughtfully reach out first to your connectors then to all relevant investors all within a very short time-span (i.e. days) so that you launch the auction at the same time.

- Here is a spreadsheet template you can use as a starting point, make it your own.

- If you don’t commit to a plan and process, your fundraising will manage you instead of the other way around.

- It’s ok to change the plan as new information comes in, but actively go back and change as opposed to transitioning to week by week “let’s see approach” that rarely ends well.

- Expect this to take most of your time, plan on having others on the team pickup day to day responsibilities as much as possible so you can focus on driving the process with high velocity and focus.

- Start preparing your deck and data room

- You need an impressive deck, not to present it, but to share it ahead of time so you can then have intelligent conversations with investors. Your deck needs to share a story that is Radically Simple. Instantly Credible. Can’t-sleep Exciting (see my other blog post). You never share it externally until phase 3, because it will create the perception you are already running the action and will “start the signaling clock”. When you are in Phase 2- you can pull up a slide or two if relevant during investor conversation saying “great question, we’re starting to put our deck together and we can take a look at a draft slide, would love to hear your thoughts”.

- Data Room (see a template of assets):

- Business Data Room – this is optional, but I highly recommend it. The benefit of having it is that it can accelerate the process and create more FOMO. If you have a data room covering a variety of topics, investors will assume that you organized it since others have asked for different data points and you are sharing it with them as well. OTHERS…. INTERESTED = FOMO. Below is a sample set of topics for your data room. I highly recommend having at least some of this ready, in the grand scheme of things it’s not that much effort and improves the likelihood of success (here is an explanation of what’s inside each folder).

- Legal Data Room – assuming you are more than a 3 person operation you will need this, but it’s not worth the effort just yet, it can be pulled together rather quickly with your lawyer and accountant after there are term-sheets. If you have big legal red-flags (e.g. an active lawsuit against you) you will want to mention it earlier and prepare materials to allow potential investors to evaluate it ahead of time and have it factor into your “Price Discovery”. Otherwise it could disrupt your process later on.

- Business Data Room – this is optional, but I highly recommend it. The benefit of having it is that it can accelerate the process and create more FOMO. If you have a data room covering a variety of topics, investors will assume that you organized it since others have asked for different data points and you are sharing it with them as well. OTHERS…. INTERESTED = FOMO. Below is a sample set of topics for your data room. I highly recommend having at least some of this ready, in the grand scheme of things it’s not that much effort and improves the likelihood of success (here is an explanation of what’s inside each folder).

- You need an impressive deck, not to present it, but to share it ahead of time so you can then have intelligent conversations with investors. Your deck needs to share a story that is Radically Simple. Instantly Credible. Can’t-sleep Exciting (see my other blog post). You never share it externally until phase 3, because it will create the perception you are already running the action and will “start the signaling clock”. When you are in Phase 2- you can pull up a slide or two if relevant during investor conversation saying “great question, we’re starting to put our deck together and we can take a look at a draft slide, would love to hear your thoughts”.

Phase 3 – “Running the auction and activly raising”

It’s money time, literally.

You are ready, have interested investors, deck, most of the data room, it’s time to make it happen.

Your goal is to bring everyone to the table at roughly the same time (follow the timeline you committed to.) This creates FOMO, it creates positive signaling value and doesn’t allow any single investor to hijack your process. Meetings will need to happen quickly in rapid succession. When an investor gives you a term sheet you set up the process well so that you are able to tell other investors that you have a term sheet and they will be “ready-enough” to compete if they are sufficiently interested. Your goal is to move all of those “I’m really interested, would love to chat more” to a hard YES (i.e. Term sheet) or a hard NO. You are happy with both.

You do this by following the key steps we outline in the fundraising timeline sheet:

- Reach out to all relevant investors on roughly the same day (personalized notes of course)

- Schedule meetings for the following week. If you get back people telling you they can only meet in a month you can now credibly respond that it won’t be relevant by then so if they are potentially interested you should find a time next week.

- Be polite, but very clear that there is a lot of interest and the process is moving forward quickly. You should also be able to articulate to each investor why you would love for them to be “The One”. Valuation matters but it’s not only about valuation, there are many more factors. Find the ones that each investor possess and articulate it to them. This is important. When an investor considers giving out a term-sheet / competing in the auction, they want to know that if they do so there will be a high likelihood that you will choose them.

- This is basic, but never agree to anything related to deal terms when you first hear of them on the phone. Always polite, tell investors you will process it offline and get back to them. This gives you both the ability to be more thoughtful and also more control of the timeline.

If you prepared well, built up the investor and connector CRM and have done “Price Discovery” well the auction should now progress at a high velocity with meetings and progress happening in rapid succession.

It’s critical not to pause or slow down since if the fundraising process doesn’t start and end quickly, the process itself will be a negative signal to investors. Investors will ask themselves “oh, I’ve heard they are fundraising, they haven’t raised and it’s been a while, which must mean that they’ve met a bunch of people…and a bunch of people have said no… I wonder what they know that I don’t?”. Also, investors will know there’s less competition for the deal, which means they can take their time to dive in more, negotiate more on valuation, try to get better terms because there is no urgency. I’ll end with a note on luck and perseverance. Building a startup is hard. It takes a ton of effort, skill and also a meaningful amount of luck. So remember to take everything seriously, but not too seriously, we only live once.

Now go be amazing,

Amit